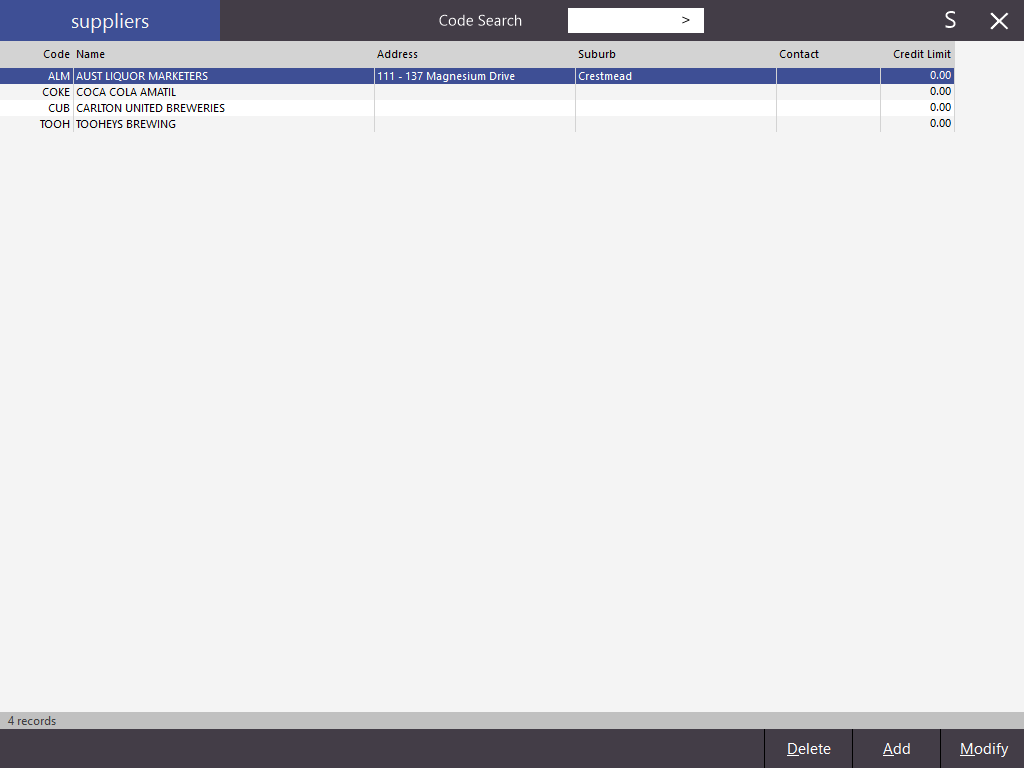

Suppliers can be added, modified and deleted by entering the supplier menu. Suppliers are entered for any stock you receive that you want to have stock control on.

Go to File > Suppliers > Suppliers.

When adding suppliers, it is a good idea to have as much information about them as possible. It is also a good idea to add your suppliers before the addition of any stock items. Each supplier record must contain a company name and a supplier code. The supplier code can only be 12 characters long, and can be alphanumeric. All other fields are optional but recommended.

It is possible for Suppliers to be imported into the Idealpos database through a .csv or .txt file. More information on using this function can be found by clicking here to go to the Suppliers section within the Import Data topic.

To add suppliers, go to: File > Suppliers > Suppliers > Add.

Depending on the Country/Region that your POS Terminals are set to (set via Setup > POS Terminals > Modify > User Details > Region), the Suppliers window may vary slightly as described and shown below:

When set to Australia, the Supplier location includes two Address fields, a Suburb field, State field and Postcode field. In addition, a Business Tax field is also shown to record the supplier tax number. The label descriptor for the Tax Number field is derived from the Business Tax Descriptor setting which can be modified via Setup > Global Options > Miscellaneous > Financial > Business Tax Descriptor.

When set to a Country/Region other than Australia, the Supplier location includes three Address fields and a Postal Code field.

The Business Tax field is not shown when the country is not set to Australia.

When the Region is set to Australia, the Add/Modify Suppliers window will appear as follows:

When a Region other than Australia is selected, the Add/Modify Suppliers window will appear as follows:

Enter in the supplier code of your choice, or Idealpos will auto-fill with the next available code. It is a good idea to fill in as much of the contact details as possible, but is not required.

The account section is where you enter the Supplier's ABN (Australia only), Account Number and Credit Limit you have with them. Idealpos has a set format that you can supply to your suppliers for help in speeding up your invoicing. You can also set the Default Delivery Method, Default Tax Rate, and select if the Supplier is linked to the Accounting add-on module. Once you have entered all the details you wish to keep, press the “Save” button. The screen will reset to enable you to add more suppliers.

This field is used to automatically populate the Payment Due Date when creating a Purchase Order or Stock Receive.

The two following options are available for the Payment Due Date. These can be configured in accordance to the number of days your Supplier gives you to pay your Invoice:

The exporting/sending Payment Due Date Days/Day of Month is currently only supported by Xero Accounting.

The number of days or Day of Month entered into the Payment Due Date field will be added to the Invoice Date to calculate the final due date that the invoice is due to be paid.

When the Supplier Invoice is then sent to the Xero API/Xero OAUTH2 Accounting Interface, the final due date that the invoice is due will also be sent.

If an accounting package other than Xero is in use, the Payment Due Date function can still be used, but it should be noted that the Payment Due Date will only be sent or exported to Xero Accounting.

If the Default Tax Rate has been set for a Supplier, that Tax Rate will be used on all purchases that are processed through that Supplier by default. This can be useful for Suppliers that always supply stock with a set Tax Rate across all of their products. If you select the Default Tax Inclusive checkbox, any invoice that you enter which is linked to the Supplier will be ticked as Tax Inclusive.

You can select which format the Supplier sends out their Electronic Invoices (if available). It is not always possible to import an Invoice from a Supplier, but the following formats are available: ALM (.dat), HLW (.INV), HLW (.txt), ILG (.INV) and Innkeeper (.DAT).

You will only need to modify suppliers if they change any of the details that you previously have stored for them, or you want to add more details that you currently did not have.

To Modify a Supplier go to File > Suppliers > Suppliers > Highlight the supplier you want to modify and press the “Modify” button > Change any details that you want modified and click on Save.

Unless you have absolutely no need for the supplier’s data, there is no need to delete them from your list. Deleting any supplier will result in data loss in many areas of Idealpos that had ever been linked to this supplier in any way.

To Delete a Supplier, go to: File > Suppliers > Suppliers > highlight the supplier you want to delete > Press the “Delete” button.

A warning box will display which you will need to confirm before proceeding.